How to Catch Up on Retirement

We want you to hear us say this: It’s never too late to get started saving for retirement. No matter how old you are or how much (or how little) you have saved so far, there’s always something you can do. You can’t change the past, but you can still change your future. The fat lady hasn’t sung yet!

According to The State of Personal Finance study, more than half of Americans are not currently investing for the future, and even more (60%) feel behind on their retirement savings goals.

It’s time to wake up, people! But don’t let that alarm clock scare you. We’re going to walk through a few ways you can catch up on your retirement savings together.

First, a quick warning—there are about to be a lot of numbers thrown around, but in a good way! Ready? Let’s do this!

How to Catch Up on Retirement Savings

If you’re afraid to take a peek at your 401(k) balance or feel hopelessly behind when it comes to saving for retirement, it’s not too late to get back on track!

How much will you need for retirement? Find out with this free tool!

Let’s say you’re 40 years old with a $55,000 salary and nothing saved for retirement. We recommend you save 15% of your gross income for retirement, which means you should be investing $688 each month into your 401(k) and IRA. If you did that for 25 years, you could end up cracking the $1 million mark at age 65. That’s right—you would be a millionaire!

But what if you’re 45? Or what if you’re already in your 50s? Here’s where you can take advantage of your age. People age 45–54 are hitting their peak earning years, with the typical household income hovering around $97,000 a year.1 If you invest 15% of that, you’ll be putting away $14,550 a year for retirement!

If you stay focused on your retirement dream and continue investing that amount every month for 20 years, you could have more than $1 million saved for retirement! That’s the power of time and compound interest at work. You can run some numbers for yourself with our investment calculator, which will do all the math for you.

1. Max out your retirement accounts.

It’s not surprising that the vast majority of millionaires (80%) we talked to for The National Study of Millionaires said that investing in their employer-sponsored retirement plans was the key for building wealth.

After all, 401(k)s, 403(b)s and other employer-sponsored retirement plans come with some amazing features that make them perfect for building a million-dollar net worth, like employer matching and tax-free or tax-deferred contributions and investment growth.

Employer-sponsored plans also have higher contribution limits that can help you. For 2023, you can invest up to $22,500 into your 401(k)—and an extra $7,500 as a "catch-up contribution” if you’re age 50 or older.2

Let’s say you woke up at 45 years old with nothing saved for retirement before deciding to max out your 401(k). What would happen? Well, if you invest $22,500 every year for 20 years in good growth stock mutual funds, you could retire at age 65 with about $1.6 million in your nest egg. And that’s without factoring in a company match on your contributions!

Plus, we haven’t even talked about your other secret weapon: the Roth IRA. For 2023, you can contribute up to $6,500 into an individual retirement account outside of your workplace ($7,500 if you’re ago 50 or older).3 Between your 401(k) and Roth IRA, you can really gain back some lost ground and make a comeback for the ages!

Now, if you’re wondering how you can do that, don’t worry—we’re going to show you some practical things you can do to start saving more for retirement today!

2. Look for savings in your monthly budget.

If you want to put more money toward retirement, you probably don’t have to look very far. Give yourself a goal to reach for by choosing a specific dollar amount you want to save. Maybe sit down with your spouse or an accountability partner and look for $250 you can shave off your budget.

Here are some quick ways you can potentially save hundreds of dollars:

- Cancel subscriptions and memberships. Do you really need Netflix, Hulu and Disney+? Pick one and dump the rest! The same goes for those gym memberships and magazine subscriptions. And don’t get us started on cable—cutting the cord could free up more than $100 each month that could be used to save for retirement!4

- Cook meals at home instead of dining out. Americans spend more than $3,000 eating out at restaurants each year.5 That means the average person is spending $250 each month! Cooking meals at home instead of eating out can save you hundreds of dollars each month. Your wallet—and your waistline—will thank you.

- Get a better deal on car insurance. When was the last time you shopped around for car insurance? If it’s been a while, you might want to take a look. Those who do shop and end up switching insurance could save hundreds of dollars on their annual premiums. Have an independent insurance agent shop around for you to see what kind of savings you can get!

The list could go on and on. We're not going to lie: Cutting some things from your budget can be painful. You might need to give up your annual summer vacation to the beach or say “No!” when your friends want to go eat at that fancy restaurant. But remember, you’re making short-term sacrifices that will help you retire on your terms—and that’s worth fighting for. You can do this!

3. Find ways to increase your income.

Your income is your number one wealth-building tool. We know you don’t want to hear us say this, but get a side hustle. Whether it’s delivering pizzas on nights and weekends or tutoring kids in math or English, there are hundreds of things you can do to make a little more money on the side. Who knows? You might actually have fun doing it!

Got an extra room? Rent it out! If your kids have gone off to college and flown the coop, maybe you can consider renting out that room for some extra income.

Let’s say you’ve got an extra $500 flowing in each month—what could that do for your nest egg? The answer is: a lot!

Meet Dan. He’s 50 years old with $100,000 saved up for retirement. That’s better than nothing, but Dan still has a lot of work to do! Right now, he’s putting $300 each month into his retirement savings. At that rate, he’ll have about $653,000 saved up for retirement by the time he turns 65.

But if Dan takes on a side hustle or rents out his spare bedroom and starts adding an extra $500 to his 401(k) and IRA each month—bringing his monthly contributions to $800—he could have $880,000 saved up at age 65. That’s almost a quarter-of-a-million-dollar boost to his nest egg!

4. Turn your home into a wealth-building tool.

You probably have a secret weapon to help you catch up on your retirement savings—and you might not even know it. In fact, you’re probably sitting in it right now. It’s your house!

According to the largest research study of millionaires ever done, it takes the average millionaire 10.2 years to pay off their home. There’s a reason for that. Owning your home means you can enter retirement with a huge asset that’s separate from your retirement savings. More importantly, getting rid of your mortgage allows you to supercharge your investing.

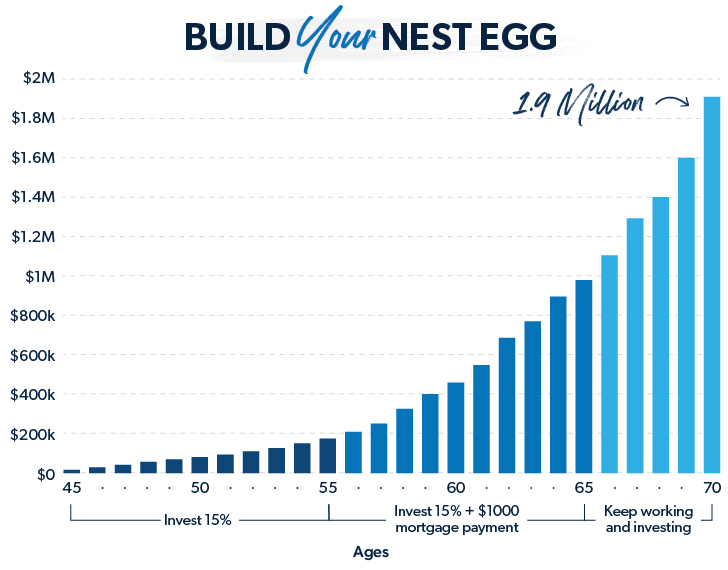

So, one thing you can do to catch up on retirement is focus on paying off your mortgage as fast as you can while you’re investing 15% for retirement. Let’s say you’re 45, making $73,500 a year and have a $1,000 monthly mortgage payment. For the next 10 years, you invest 15% of your income for retirement and commit to paying an additional $500 a month on your mortgage.

In that time, you could pay off your mortgage while also building up your retirement savings to around $200,000.

Now you’re 55. The house is yours free and clear, but retirement is right around the corner. It’s time to put the pedal to the metal. You increase the amount you save each month by $1,000—your old mortgage payment amount.

Over the next 10 years, you could build your nest egg up over $1 million!

In 20 years, your retirement vision becomes a reality instead of a pipe dream. You’ve got a paid-for home and a more-than-decent nest egg waiting for you. And that happened by staying focused on your long-term goal and working hard to get there.

Having a paid-for house also gives you a second option. You could sell your home and use a portion of the proceeds to buy a new, smaller home with cash, then put the rest toward retirement.

5. Push back retirement a few years.

Uh-oh. We can practically hear the grumbles from across the internet now. Now hear us out: If you feel like you’re really behind, what if you kept saving and working until age 70? That gives compound interest five more years to do its thing, and those five years can make a world of difference.

Working longer is not an option for everyone, but if you’re in good health and enjoy your job, staying longer is a great choice—not only for your mental health but your financial health as well.

If you invest $800 a month from age 45 to 65, you could end up with close to $700,000 in your nest egg. That’s not bad! But if you stayed focused and kept working and investing for five more years, your retirement savings would potentially grow to $1.2 million. That’s compound interest working its magic!

Work With an Investment Professional

If you’re late getting into retirement investing, there’s still time to get back in the game. But it’s time to get intense and start putting habits in place that will help you get to where you need to go.

That’s why you need to work with an investing professional you can trust.

Reach out to us at Clarion Advisors at (530) 889-0200, and we'll get you going on the right track.